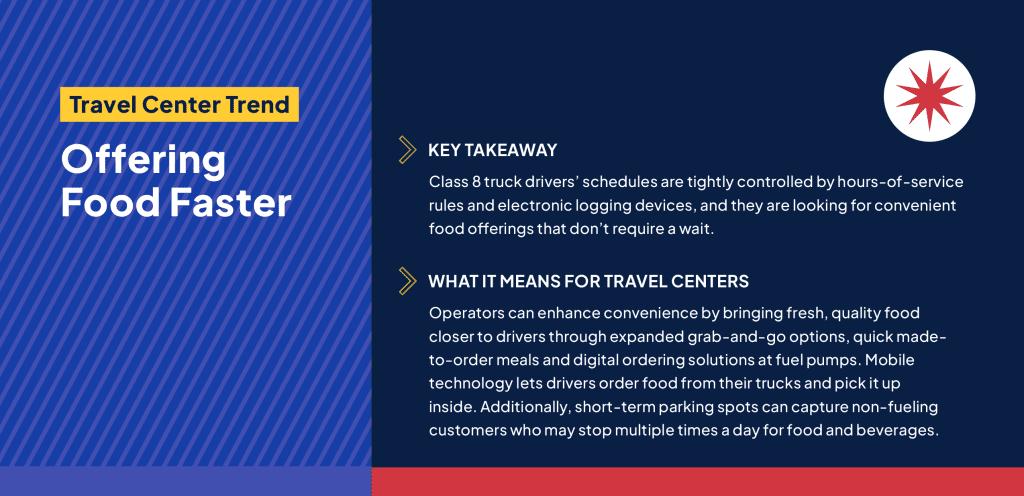

For Class 8 truck drivers, hours-of-service regulations and electronic logging devices strictly dictate how they must spend their time. Finding new ways to shorten the distance between drivers at the fuel island and fresh food continues to trend in the travel center industry.

Bringing food closer to the driver, strengthening grab-and-go food offerings and finding new ways to speed drivers through a location can increase convenience, boost sales and make a location a preferred stop.

“Grab-and-go, made-to-order and restaurants- have different and important roles to play,” said Jessica Williams, founder and CEO of Food Forward Thinking. “With the large lots and volume of customers at truck stops and travel centers, all three are table stakes expectations for visitors.”

“Our customers come to our stores, and they’re trying to hand us money. We need to make it as easy as possible for them to give us money,” said Schulte.

Going Mobile

There are several key locations on the customer journey where locations can position food, and one of the first places to connect is right in drivers’ pockets by letting them use their cell phone to order food while they’re pumping fuel or sitting in their truck.

“Mobile ordering continues gaining traction,” said Peter Rasmussen, CEO and founder, Convenience & Energy Advisors. “I think wherever you can offer a link to order ahead, whether that be in your app or linked out to some of the different platforms that you could be working with, it goes a long way.”

QR at the Pump

There are several ways to deploy mobile technology.

QR codes allow drivers to scan the code, access the menu and place their order. Food can either be delivered to the pump or be waiting inside. Rasmussen said drivers expect ordering to be easy, and they don’t want to have to download an app if they don’t have to. “The QR code can take drivers to a web form where they can pay with Apple Pay or Google Pay.”

When Dale Elks, a regional manager at DAS, managed a truck stop, he added QR codes at the pump to increase convenience for drivers while also increasing sales. “By the time they got finished fueling, we had the food ready for them, and they would just come in and pick it up,” Elks said. “You have to jump on technology at the pump to drive extra business.”

Elks tapped into the same QR technology restaurants turned to during COVID to allow diners to view the menu and pay. “We numbered the tables Pump 1, Pump 2, Pump 3, Pump 4…so when the ticket prints in the kitchen, it let the kitchen know immediately it was a to-go order and major priority,” he said, adding that servers deliver the orders to the fuel desk.

Drivers could order anything available at the location’s quick-service restaurants and its diner. “We started out with a limited menu, but we just kept expanding it and expanding it,” Elks said. “It didn’t take any effort because we were already serving the food in the restaurant, but we saw a huge uptick in more meals sold than sandwiches and burgers.”

Initially Elks thought drivers would want food they could eat easily while driving. “We found out a lot of drivers would get their food, pull off the fuel island, and sit in the parking lot for 10 minutes and eat it right before they would go. They just didn’t have time to shut their truck down, walk into the build and sit down, get waited on, get the food and come out.”

Food sales increased 27% with the QR codes. “They were able to still get that meal they wanted without having to go inside and get something off the grab and go,” Elks said.

Taking Mobile Further: Using Apps

New technology is making high-quality apps more accessible to operators of all sizes, and operators can integrate food ordering features into their app or other first-party ordering system.

“From an investment standpoint, it is a lot less expensive than it used to be and ultimately it is what business case will you get from it, Rasmussen said, adding that once a program matures, it boosts sales by 4% or more. “What you can’t quantify is now who comes here every day because of it.”

There are first-party ordering systems, which use the location’s own platform, such as a website or app, for customers to place orders directly. “Paytronix, Vroom, Olo, Lula and Altain can create your first-party ordering, but they are also third-party aggregators,” Rasmussen explained.

As third-party aggregators, the solutions can enable drivers to order via Door Dash, Uber Eats, GrubHub and other online ordering solutions. Typically, aggregators charge high commission fees per transaction, so operators can adjust prices and rates accordingly.

Rasmussen added that the PDI Open Commerce platform enables truck stop operators to integrate digital ordering systems seamlessly into their existing operations. “If you change a price in the store, it changes online,” he explained.

With Altaine’s platform, for example, operators sync with PDI, then decide what items they want to sell and broadcast it out. “If you have a loyalty program, they automatically sync. If you have price book platforms, they automatically sync,” Rasmussen said. “As that relates to broadcasting on your first-party platform, you don’t have to do much from the time it is built. That will then broadcast out to Uber, Door Dash, GrubHub for pick-up or delivery and it will add those fees.”

In addition to food offerings, operators can list c-store products for either in-store pickup or delivery, which Rasmussen recommends. “A lot of platforms are driven by search,” he said. “If a driver is searching for Advil, do you want it to come from Walgreens or your store?”

Connecting ordering with loyalty apps creates the added advantage of collecting information about customers, so locations can customize their promotions. Creating special offers only available via the app also incentives those who don’t have the app to get it.

“Segmenting offers is where I see the most powerful advertising come through,” Williams said. “If you have a loyalty app and can see what those customers are purchasing, it is most effective to offer what they’re buying.”

Making Grab-and-Go Easy

Having high-quality grab-and-go food, including hot offerings, and drinks also helps drivers get back on the road quickly.

Schulte encourages operators to think outside of the box when creating their grab-and-go offerings. “Sushi isn’t the first food one thinks of picking up while on the road, but it is becoming a real power player,” he said, adding that one NATSO member had success bringing a sushi chef in once a week. “If you don’t have sushi in your floor merchandise or your walk around floor merchandise, you’re missing an opportunity.”

Raw cookie dough, more sophisticated sandwiches, Indian food and other ethnic cuisine are selling well for a lot of operators. “There is no doubt that pizza, chicken, hot dogs and hamburgers sell, but if you’re not supporting your food program with these other things, you’re not maximizing your food offerings, Schulte said.

Customization and the appeal of freshness are key factors in the decision-making process for meals, making fast made-to-order foods appealing. “I am seeing an increase in made-to-order food in truck stops and convenience locations that mirror the Subway and Chipotle models,” Williams said.

Rolling out a self-serve taco cart or setting up a salad bar allows customers to choose what they want and pay by the pound. Another of Williams’ customers, Corner Post, a truck stop in Watford City, N.D., has had so much success with tacos that they dedicated a corner of the location to a taco shop, Taco Esquina. Drivers don’t create their own taco, but they do add their own condiments.

No matter what type of food operators decide to offer, Williams recommends they focus on quality. “Even if customers aren’t in a hurry, a great variety of high-quality items is appealing and can draw customers in,” Williams said.

Adding Parking

Sean Momin, vice president of operations at Pat’s Travel Center, added quick, 30-minute parking at the end of the fuel canopy before the scale, making it easy for drivers to park and come inside.

Plus, growth in the last mile may mean more and more drivers aren’t fueling and are stopping primarily for food and beverages. Adding short-term parking near the location can help capture those non-fueling customers, many of whom might be stopping multiple times a day if they can get in and out quickly.

Top Microtrends Shaping the Truck Stop and Travel Center Industry in 2025 Report

Staying ahead of industry trends—especially microtrends—enables travel centers to seize new opportunities, adapt to market dynamics and meet customer needs proactively. The NATSO Foundation created the Top Microtrends Shaping the Truck Stop and Travel Center Industry in 2025 Report to provide actionable insights to help operators maintain a competitive edge.

The Top Microtrends Shaping the Truck Stop and Travel Center Industry in 2025 Report was created with generous support from CAT Scale.

Subscribe to Updates

The NATSO Foundation and NATSO provide a breadth of information created to strengthen travel plazas’ ability to meet the needs of the traveling public in an age of disruption. This includes knowledge filled blog posts, articles and publications. If you would like to receive a digest of blog post and articles directly in your inbox, please provide your name, email and the frequency of the updates you want to receive the email digest.